Hylobiz marketplace helps to grow Small and medium businesses as they are the key players for growth in any economy, as they are the key contributors to any economy’s GDP and employment.

Despite being the backbone of an economy, still, they were facing many problems related to collection, invoicing, and working capital challenges. Generally, businesses are hesitant to adopt new technologies for every business function, which involves extra cost, effort, and time. So, there was a need for a solution/tool that could have helped businesses with automation without any process change.

In this blog, we will be discussing Vishal’s (our CEO) perspective on the Hylobiz marketplace. We will get our questions answered from him.

So with this now, let us jump to know from Vishal what has led him to the idea of starting Hylobiz?

Hylobiz started as a “ZERO PROCESS CHANGE” collections and payouts automation for the businesses.

In 2018, Vishal noticed that every second SME fintech focussed company was trying to provide working capital loans to businesses. At that time, Hylobiz looked at the opportunity a little differently.

Instead of offering the capital straight away, that comes with challenges of finding the customer, credit rating, NPAs, collections, etc. Firstly, we thought of adding value to their businesses by optimizing their cash flows. Once we have in-depth knowledge of their business, We will offer them other financial services like credit, insurance, taxation, banking, compliance, etc on our financial marketplace.

The idea was to build an automated business banking platform in a box without having to change any existing workflows of an existing business.

How do you differentiate yourself from your competitors? / What does the Hylobiz Marketplace do for businesses?

While adopting a new solution, every business is hesitant as it involves the cost of training and process change. Also, the available solution was not suitable for every kind of business.

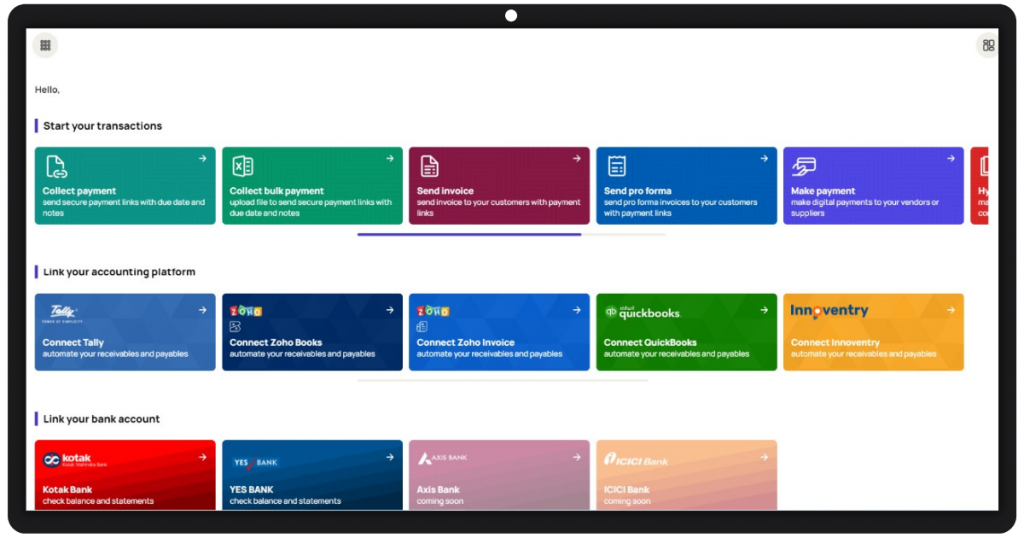

Our Core differentiation is all the heavy lifting we do for the businesses at the micro-integrations level. We allow the existing/ongoing business entities to integrate their ERP with Hylobiz in a few clicks in the lowest set-up time. With this simple integration, all your collections, payables, and capital requirements are taken care of with Hylobiz. Our solution helps businesses save time and cost, with improved business efficiency and growth.

We are adding new services like E-invoicing, e-way bills, GST, etc which is shaping Hylobiz as the richest services stack for SMEs/SMBs.

Read more on E-invoicing: https://hylo.biz/what-is-e-invoicing-under-gst/

Who is your targeted customer?

Our typical customer is a business that operates b2b transactions within any supply chain/distribution network. Our solutions are suitable for any business, be it a manufacturer, distributor, dealer, trader, wholesaler, or importer/exporter facing typical challenges around managing/reconciling their incoming cash and timely payments to be made. We solve this and automate it end to end via connected ERP and connected banking capabilities built within Hylobiz.

How do you look at the fintech industry?

In today’s world, “collaboration is the key to success” – it is rightly said because the Fintech industry is shaping to work closely and complementarily with the banks and financial institutions. Fintechs technology helps banks improve their User experience and customer reach with its capability to build deeper use cases on engaging with the target user base based on their day-to-day business transactions. Banks / FIs / Lenders / Insurance companies are eager to access these data to serve their users better. Vishal believes that fintech will play a strong role and be the fabric that stitches the Users and the financial services world.

What is the current growth for Hylobiz?

Hylobiz has over a hundred thousand businesses on the seller-buyer network on the platform. Cumulatively Hylobiz has processed upwards of 500 crores of collections through the platform within two markets, India and UAE.

The transactional data flowing through Hylobiz and the extra capabilities that we are rolling out is making our service stack richer to offer more to users as explained above.

Now, We are working with more than 10 banks / FIs in India & UAE integrated with Hylobiz, along with 10 plus ERP / accounting engines out of the box integrations for the businesses to be able to automate the collections and pay-out via Hylobiz.

What are your plans related to the Hylobiz Marketplace?

We will continue to strengthen our existing ERP integration tools or accounting and banking partnerships to help businesses in gaining tighter control of their cash flows.

We are looking forward to adding more financial services to the financial marketplace to be a single window for business owners to grow their scale.

Conclusion

We at Hylobiz are committed to our vision of simplifying business processes and driving efficiency through automation of collection, payables, and working capital management along with adding value to their businesses.

We aim to add more services to our platform to help businesses scale and grow with Hylobiz.

Recent updates at Hylobiz:

Recently Hylobiz has become VISA-ready certified as a part of the Fintech partner connect program. Through this partnership, Hylobiz will serve VISA clients in the CEMEA region. Also, this is a validation of us being a trusted brand.

Read more on our VISA Certification: https://hylo.biz/hylobiz-is-now-visa-ready-certified/

We are delighted to share that on 1st April, we launched GST e-invoicing software on our platform with top-class features to help businesses become e-invoicing compliant as per the government mandate.

Improve your business with top Hylobiz Marketplace features:

- Integrate your existing ERP at zero cost

- Create an invoice/e-invoice of your choice and attach payment links to them.

- Automate your AR/AP.

- Improve customer experience with our pre-integrated payment gateway

- 360 control of your business cashflows

- Real-time dashboard

- Automated business reports

- ISO-certified platform

Visit our SME offerings page: https://hylo.biz/offerings-sme/

Follow us on Medium: https://medium.com/@hylobiz

Come and onboard on the Hylobiz Marketplace to elevate your business health:

Sign up today: https://app.hylo.biz/login

Read more: https://hylo.biz/hylobiz-celebrates-and-supports-women-entrepreneurs-and-professionals/

Visit our blogs page: https://hylo.biz/blogs/

Reach us: support@hylo.biz