How often have you heard any of these excuses?

the amount is beyond budget

the Manager was not authorized to sign the deal

invoice is not yet received

the accounts team is waiting for approval

SMEs ’ the lifeline of an economy cannot delay the goods/services by even a day, but payment is made at per the convenience of the buyer. That’s the story of an SME!

The Story of Late Payments for SMEs

These late payments are driving SMEs crazy with mental stress, financial losses, and constant follow-up wasting man-hours and time with no incentives. Delayed payments significantly impact smaller businesses, as the limited cash flow does not allow them to carry out business as usual without a steady flow of funds coming in.

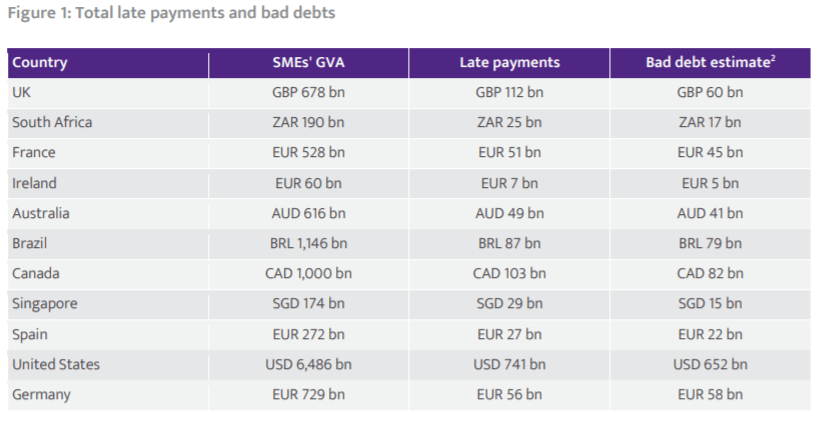

A look at the statistics of how late Payments for SMEs are getting worse each day –

- Late payments costing UK SMEs £23.4bn – Recent data from Pay.UK suggests that late payments to the UK small to medium-sized (SME) enterprises in the past year have doubled – that’s right, almost doubled in a year. SMEs in the UK are now waiting for late payments that total around £23.4bn. That figure was around £13bn in 2018. 78% of SMEs are still waiting for payments from their clients that are more than a month after the agreed payment date

- Rs 1.8 lakh crore was trapped in India Inc’s balance sheet – an EY report estimated that Rs 1.8 lakh crore was trapped in India Inc’s balance sheet mostly as receivables. Media reports estimate that large corporations owe Rs 40,000 crore and PSUs Rs 48,000 crore to MSMEs. Receivables pile up, shrinking their working capital.

- 11.0% of all invoices issued by SMEs are paid late – Another survey sample states that 11.0% of all invoices issued by SMEs are paid late, which would equal a total of USD 1.01 trillion per year. Worse, 7.5% of invoices are eventually written off as bad debt, which will have an even more significant impact on operations

How Late Payments for SMEs Affect?

- Chasing Late Payments for SMEs- The SMEs are small businesses that do not have a surplus, now putting money into human resources to chase the payment involves an additional financial burden. A survey done shows that in South Africa ~3500 USD on an average of 20 days are spent by SMEs to chase payment. That sounds like a massive cost for a small business.

- Delayed payment hamper operational actions – Late payments for MSMEs make it difficult for an SME to conduct day-to-day activities for business to run smoothly eg – Staff Pay, Bonuses, paying their own suppliers, allocating budget to expand.

What are The Reasons for Delay?

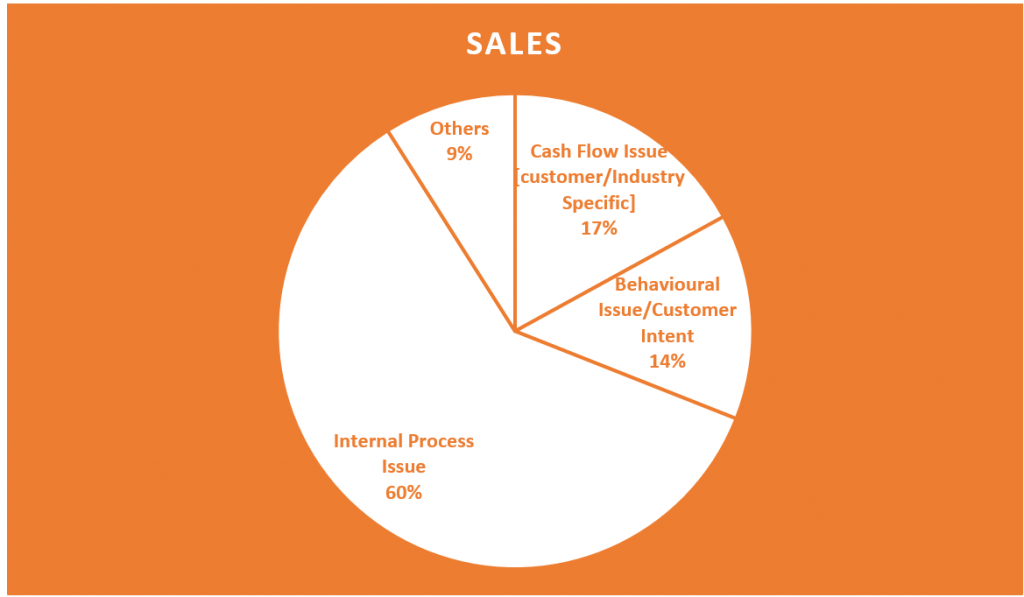

A couple of surveys were done in India, the UK, and across the globe to know the reason for Payments for SMEs delays, and here are the highlights –

In India, 17% of respondents mention Customer or Industry-specific cash flow issues, while 14% cited Customer intent/Behavioral issues. But the majority 55-60% says internal process issue causes delayed payments. The reason could be

- Delays due to invoicing

- Delays due to lack of proper and on-time customer solicitation

- Delays due to reactive customer credit risk process

- Delays due to the incorrect or late allocation of customer payments

- Delays due to the internal staffing issue

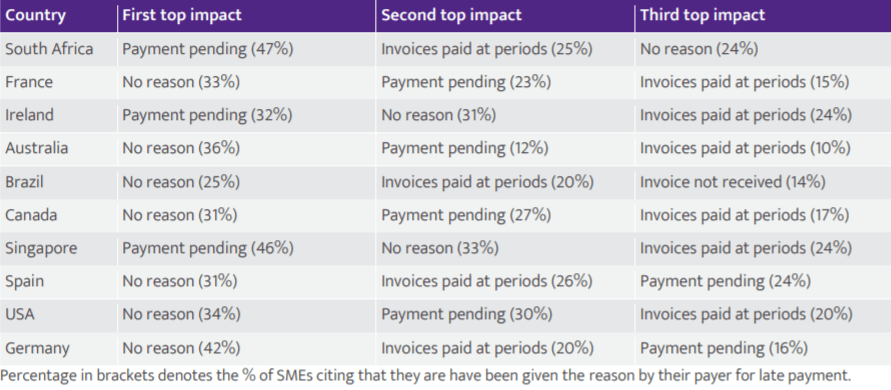

Another survey done at a global level highlights the most common reason for late Payments for SMEs–

However, an interesting point is that many survey respondents opted for the most common reason given is no reason. This suggests that there should be no particular reason why invoices should be paid late, and so companies should generally be amenable to a mandate of punctual payment.

What an SME can do?

While government and regulatory authorities are Dubai government has made plans to shorten Payments for SMEs to 30 days instead of 90 days. In India, the RBI panel has suggested setting up an info utility to spot payment defaulters.

However, these actions do not fully work in SMEs ’ favor. What you need is a transparent system that removes the reason for “invoice not received” and everyone can see where the invoice is when it was raised. How many days till it’s due and chasing customers digitally.

Hylo and exclusive SME Neobank can assist you with collecting and tracking payments, updating payment details, and generating reconciliation reports. To know more contact us here.

We have been changing the lives of many SMEs in India and UAE. You deserve Payments on Time