As a business owner, have you observed irregularities with an invoice?

Most businesses know the importance of keeping the accounting clear, but with multiple stakeholders involved, one still faces transaction mismatch, fraud, and human errors.

Invoice Reconciliation can help you avoid any such issues. Today’s post will aid in understanding the benefits, issues of reconciliation, and getting back on track with your business. So let’s get started –

What is Invoice Reconciliation

Invoice reconciliation is the matching of credit and debit against the invoices/bills generated/submitted.

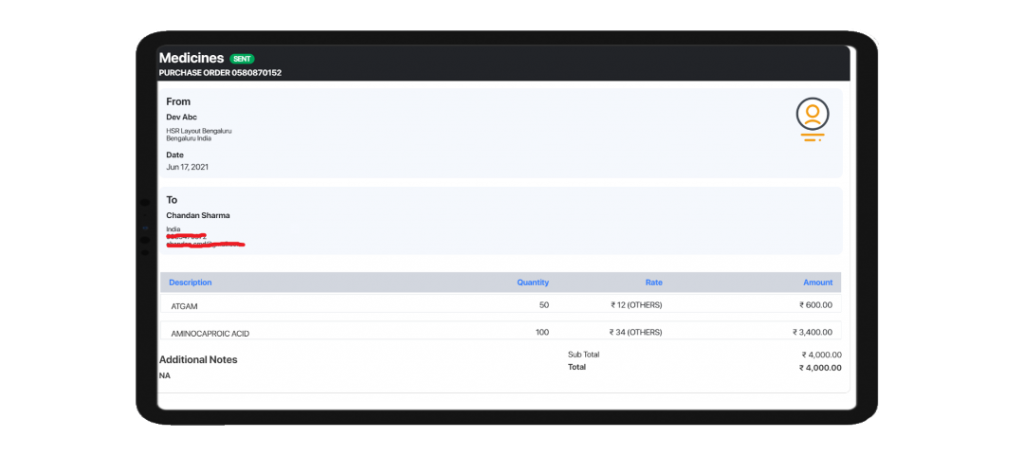

For example – if you are a distributor of Pfizer and offer medicines to retail shops. Retail Shop 1 raised a PO [Purchase Order] and sent it to the distributor.

The distributor packs the order and sent it to the Retailer with the invoice details

After receiving the invoice, the Retailer, as per the SLA, makes the payment.

By the EOD, the accounting team would match the credit that happened with the invoice number.

This matching of the transaction to its designated invoice is called Invoice Reconciliation.

Why is Invoice Reconciliation Important?

Invoice Reconciliation is essential to know your Business health. By matching the transactions with the invoices, you can

Know the Business Health

Your business health is determined by the revenue it is generating, and that is dependent on how many invoice reconciliations in partial/full have been paid. So if you have a clarity of say 10000 invoices you create every month, and every day you receive a payment of say 100-150 invoices, there is a massive gap in terms of your earning and liquidity in the pipeline.

As a business owner, you would have paid your supplier for the items, but your buyers are yet to pay you. That is an indicator of too much money invested, and you need to strategize to collect payment and regain your business health.

Identify Fraud

When you are using paper-based invoicing, there is the chance of “Fraud” because the papers can be misplaced, destroyed, and even eaten by termites. According to the Association of Certified Fraud Examiners (ACFE) in their 2018 Global Study on Occupational Fraud and Abuse, a lack of good internal controls is responsible for nearly half of all fraud cases. Reconciling your vendor invoices is a primary internal control for your accounts payable department.

Prepped for Legal Audits

Many businesses get audit notifications from the tax authorities to check if there is a mismatch, so if you got credited a huge amount and cannot find its invoice/justify from where it came from, it can attract a fine. Imagine this situation when you do not reconcile for days/months,/years; it can get messy.

Hence reconciling periodically is a good practice and preps your business from any fines/penalties.

Expand Your Business

This pro is kind of linked with your business health. If you are making a good profit, you can look out how to use the revenue to expand and create new business opportunities.

If you are struggling to get your invoices paid on time, check our post Top Invoicing Mistakes made by Business Owners, which delays the payment, and How Hylobiz can help avoid them here.

Why Invoice Reconciliation needs to be Automated?

The example that we discussed a Pfizer distributor and its Retailer for invoice reconciliation was just one trade, expand and think about it in a real-life situation. Each business/distributor/SME

- He has to deal with 100-1000’s of invoices to take care of?

- The complexity of matching the invoices with credit & debit gets amplified when a business uses multiple accounting software.

- Every day the accounting team needs to run an EOD report to settle and match the transactions and update all the ERP.

- Also, consider the paperwork involved with invoices sent via paper mode and scanning and uploading it into accounting software.

- Not to forget the probability of manual error or fraud that can happen with manual reconciliation

- What happens when the owner thinks of expanding the business? Hiring new resources would be good, but again there are chances of manual error

- Also, for the accounting team to do the mundane job is again tiring and exhausting.

All of these complications make it hard to scale the manual reconciliation, and that’s why Automated reconciliation is the need of the hour and way forward for your business growth.

Still in a dilemma of whether to opt for an automated reconciliation tool, check six benefits of automated reconciliations for businesses here.

How do you Reconcile an Invoice?

Hylobiz – your personal assistant can be very handy and assist you with Automated Reconciliation to all of the concerns stated above. Here is the process to get it started

- Signup on Hylobiz with the mobile number here.

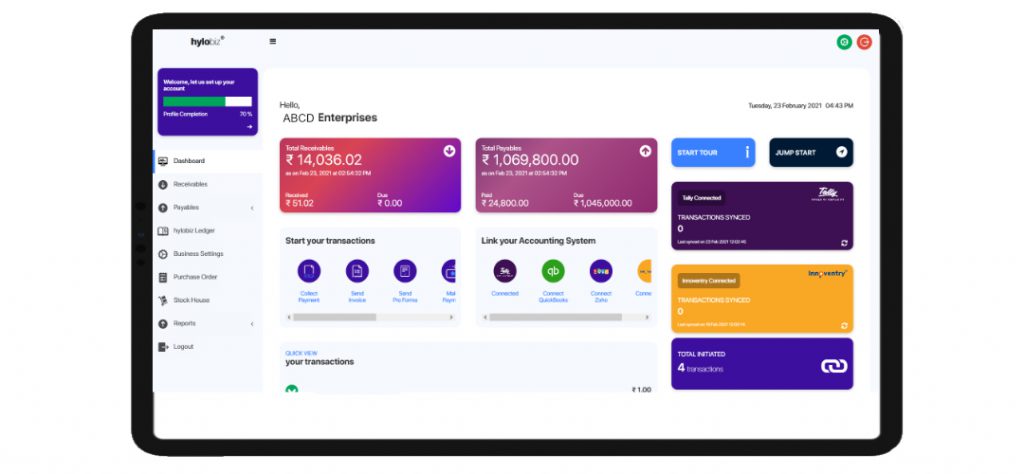

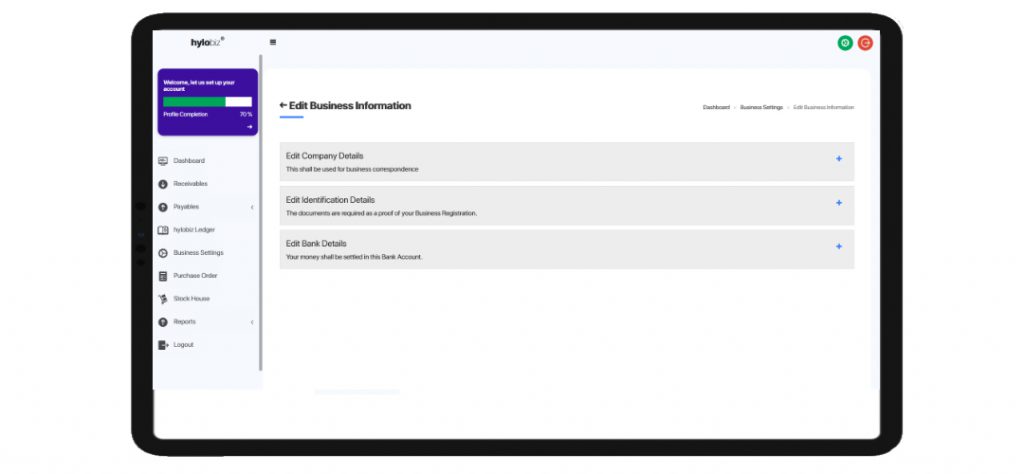

- If you are using different ERP’s or accounting software, you can integrate them with Hylobiz in just three steps after the login from the Dashboard or via Business Settings

3. You can also put in your bank account details from Business Settings. BE assured Hylobiz would never ask for OTP’s or password of your bank account. It is to facilitate invoice payment and reconciliation we need your bank account details

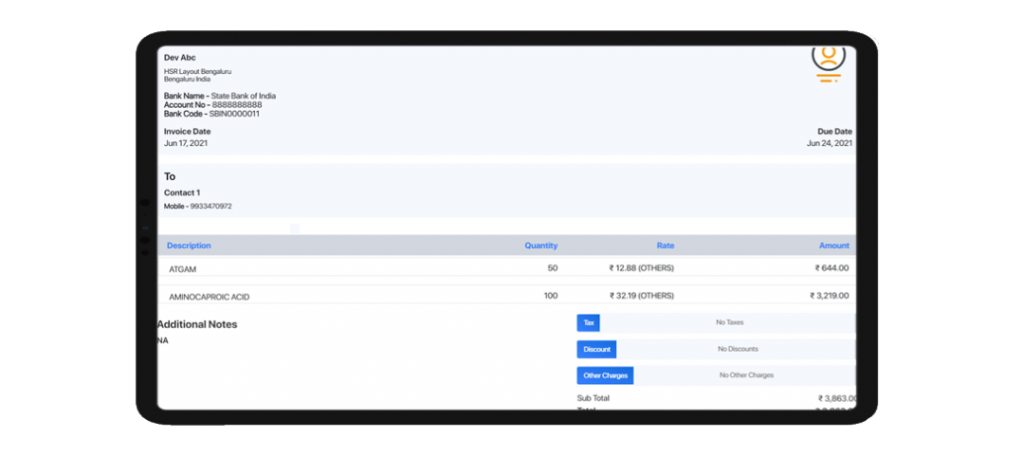

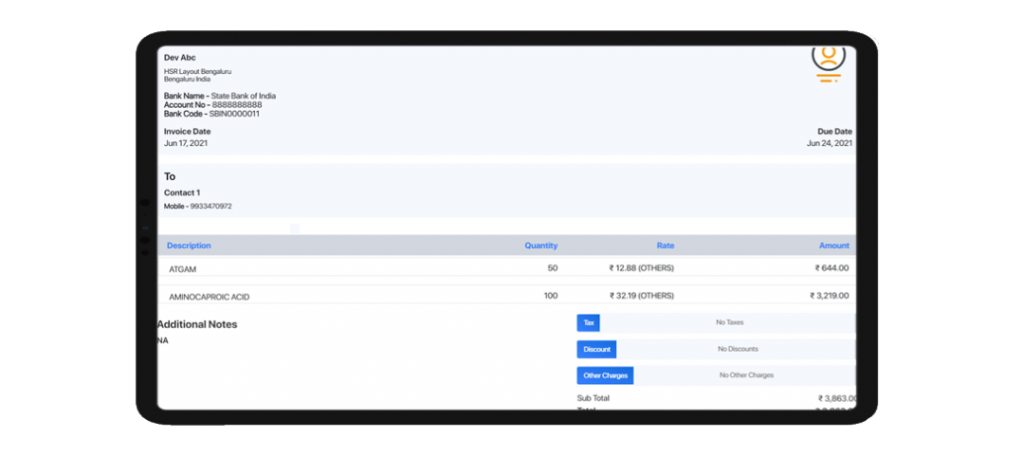

4. Now create invoices

5. Your Dashboard would be updated in real-time with each payment received

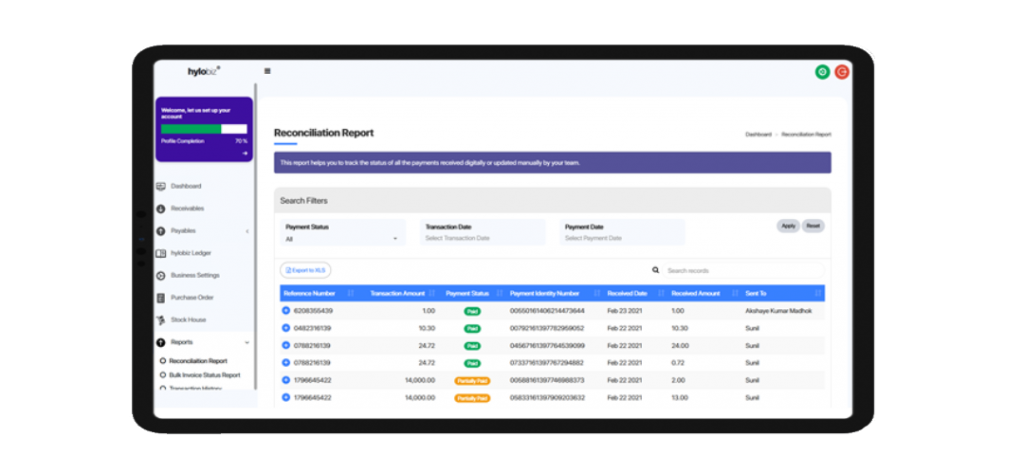

6. You can also generate the Reconciliation report under the Reports menu

Hylobiz is a Digital-first platform for all your Offline and Online Invoice Payments Collection on Time

Hylobiz is a platform that offers business owners, accountants, sales and marketing teams a way to get invoices paid faster. Loaded with seamless integration features to ERP’s and Banks, it could boost your business in streamlining payments and recognizing revenues.

Hylobiz automates manual processes, lowers transaction costs, and speeds up invoice collection.

Here are some of the features Hylobiz offers –

Invoice Collection – Hylobiz Receivables help you digitizing your collection process. You get the power to send your invoices or pro forma to your customers with a secured payment links giving multiple payment methods to your customers to make digital payments

ERP Integration – Access your ERP with our pre-integrated ERP list with Hylobiz, or upload your invoice file to kick start your digital collections with a simple two-step process

Automated Reconciliation – Hylobiz helps you with automated reconciliations of your banking transactions. All your receivables and payables are consolidated and updated in a single report with a Unique Payment Identity Number.

Credit Card, loans, and Insurance – Get Business Credit Card, loans, and health or inventory insurance. You can also extend these benefits to your customer who pays on time.

If you want to know if Hylobiz and your company can be a perfect match, schedule a free demo today.