India’s economy is one of the fastest-growing economies in the world and MSMEs are the growth engine that fuels the development of the national economy.

As per the information received from Central Statistics Office, Ministry of Statistics & PI, the Share of MSME Gross Value Added (GVA) in All India Gross Domestic Product at current prices (2011-12) for the year 2018-19 and 2019-20 were 30.5% and 30.0% respectively.

It holds around 1/3rd of the Indian GDP.

Reference: https://www.pib.gov.in/PressReleasePage.aspx?PRID=1744032

From the viewpoint of Mr. Anurag Rastogi, head of our product department, we will cover in this blog post the challenges posed by MSMEs, as well as how Hylobiz supports enterprises with their four pillars of business that is cash all commerce, compliance, and credit.

Role of MSMEs

Micro, small and medium-sized businesses are the backbone of the country’s economy. MSMEs have contributed significantly to employment over the past six decades and are essential to exports. Through their creativity and business, Micro, small and medium-sized has been playing a key role in the economy’s development by expanding their sphere of influence across all economic sectors.

While MSMEs businesses greatly contribute to growth, they nonetheless encounter challenges in reaching their goals. Let’s look at these barriers and their remedies.

Challenges faced by MSMEs

- Lack of technology:

Technology is the key to success for any business. MSMEs are either not exposed to or do not have enough funds to use the latest technologies that can make their business processes easier. This makes it difficult for them to compete with large corporations that can afford these technologies.

- Working Capital efficiency:

Another issue MSMEs encounter is managing working capital. There will be ups and downs in business, just like in life, therefore it’s critical for MSME to have a plan for both. Micro, small and medium-sized may struggle to make payments on time and will have difficulties running its business if their finances are not in order.

- Lack of business health visibility:

Managing operational, financial, and managerial activities is necessary for assessing the health of a business. This needs careful planning, carrying out, and monitoring. Because of inadequate teams, poor planning, bad execution, and poor management, many businesses struggle to execute these many responsibilities.

- Lack of trade Automation:

Automation undoubtedly enhances productivity, product quality, and safety, but MSMEs lack the resources or opportunities to automate their operations

- Access to credit:

MSMEs find it challenging to obtain financing because often they lack any form of collateral and banks may find it challenging to take risks in their business.

Difficulty in Managing Compliance:

The government mandates’ rules are constantly changing, and Micro, small, and medium enterprises struggle to comply with them because they lack the knowledge and resources necessary.

So who can help MSMEs with such challenges?

Hylobiz!

WHAT MAKES HYLOBIZ YOUR GO-TO PLATFORM:

Hylobiz is a B2B finance platform that assists businesses with automating invoicing, collection, and payment reminders. Reminders tools are in-built to remind the counterparties of orders/payments etc.

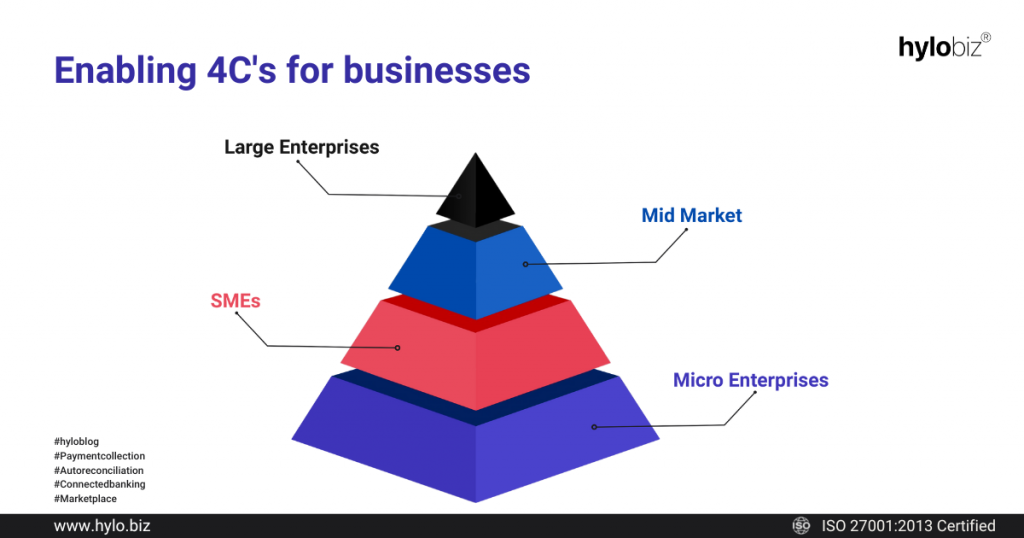

SMEs and MSMEs within the supply chain distribution networks need a holistic 4C offering to operate and grow their business efficiently Hylobiz is supporting you with the same…

Four Pillars of MSMEs and How Hylobiz Supports you?

MSMEs need to have four pillars of strength to assist them to manage their business easily and effectively through cash, credit, compliance, and commerce in order to overcome these obstacles.

Commerce

Businesses should make sure that their business inventory, invoices, purchase orders, debit/credit notes, and other documents should be conveniently shared with sellers and buyers.

Hylobiz assists you in automating vendor payments and invoice collections. Through our platform, you may create or send invoices with payment links attached and receive payments using a variety of digital methods.

While the cash management routines are followed for POs, E-Invoices, and payment reminders, sellers can advertise and share their goods with their buying network, have a digital storefront, and provide customers with a shopping cart experience.

We have pre-integrated ERPs and accept digital payments. We assist with Seamless order management with Inventory and invoice management.

Cash

Managing cash is something most businesses struggle with, even if it is making a profit will have to manage its cash flow correctly.

Hylobiz automates the exchange of invoices and ledgers via WhatsApp, and email and provides the pay-links option for immediate payment (full/partial payments). With a single dashboard view on money flows, reverse reconciliation takes place in the relevant ERPs, minimizing the difficulty in cash flow management for the business owner and accountant.

Compliance

It is crucial for a business to abide by all rules and regulations, especially when it comes to e-invoices and e-way bills. Automating these can be useful and make work easier overall.

If an SME or MSME need e-invoice or e-way bill capabilities, both Hylobiz and the APIs have it available (in case the business wants to integrate their existing tools to do the same). With integrated compliance and reconciliation, zero downtime, and fraud-proof validation, it aids in the simplification of business finance

Credit

In a corporate context, credit, or working capital, is simply money borrowed as loans to finance ongoing activities.

Businesses require working capital for ongoing operations and should have access to decent lending choices with minimal procedures.

Hylobiz provides an Infrastructure for digital credit decision-making and origination and helps in Trade financing that is integrated with cards and SCF,

We help you become credit ready.

More on Hylobiz:

Hylobiz’s Good Business Score:

Hylobiz has introduced the Good Business Score capability to give you visibility of your business health.

The Good business scores along with the dashboard and automated reports help you maintain good business health and give better access to credit.

This demonstrates your ability to handle your finances well and your ability to pay back any loans you take out on schedule.

On 19th Sep Hylobiz attended Global Fintech Festival 2022 where our CEO Vishal Gupta spoke about the 4C’s that support your business. watch the video below to know more about the 4 Pillars of MSMEs and SMEs.

FOUR PROBLEMS ONE SOLUTION HYLOBIZ!

Hylobiz’s all-in-one automated solution frees up your time with automation and helps you generate additional revenue.

Read more on our offerings: https://hylo.biz/offerings-sme/

Follow us on Medium: https://hylobiz.medium.com/

Reach us: support@hylobiz.com